Who We Serve

Medical Sales Professionals

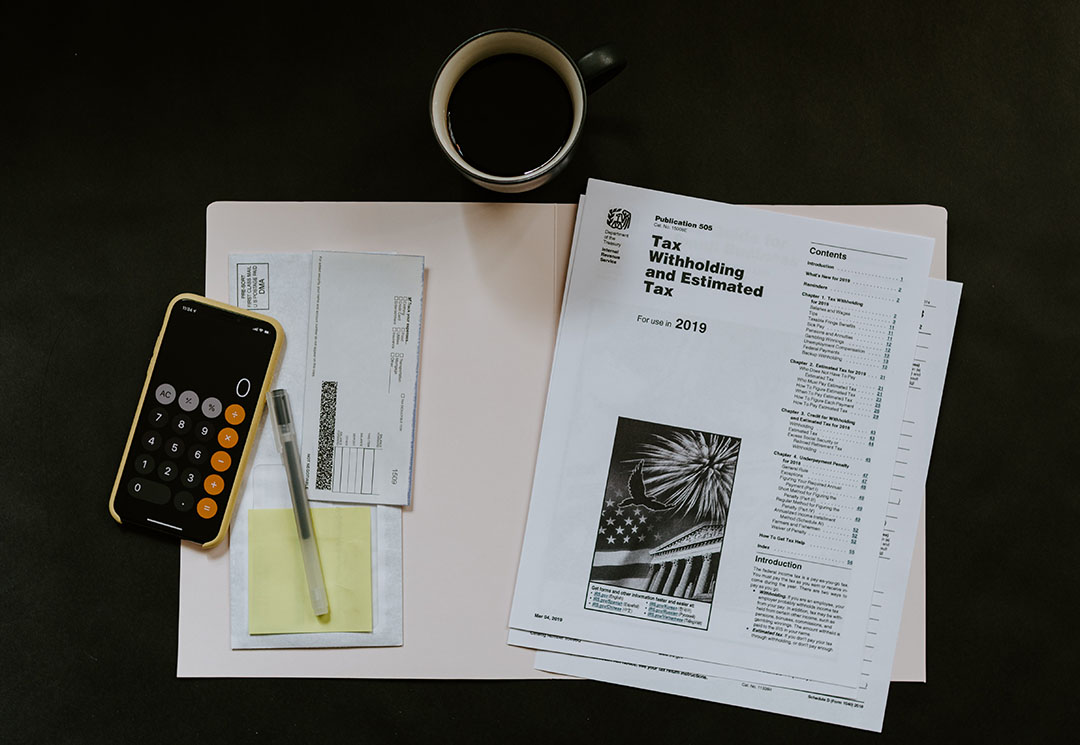

Are you a medical sales rep looking to reduce their tax bill, but can’t get clear on how?

Having trouble understanding why you owe so much? Overwhelmed just thinking of tax time? Simply hand it off – we’ll stop the bleeding.

Navigating medical industry changes while worrying about new tax laws can distract you from your full earning power. We put our decades of deep experience in the medical sales field to work for you, minimizing your tax liability and maximizing your profitability.

Medical Sales Reps

Keep your commission where it belongs – in the bank. When you’re classified as an independent contractor, you’re on the hook for both federal income tax and self-employment tax. We help medical representatives rework their tax structure to save on both. We’ll also help you file your business and personal tax returns once it’s in place.

Device Distributors

Increase your revenue, not your tax bill. Seeing your revenue soar doesn’t have to be a double edged sword. Our tax advisors have been on the other side of the IRS and know what it takes to help lower your taxes – without the complication. Leave it with us, and be done.

Sales Managers

Maximize deductions and work with the system. No one wants to leave money on the table. Unfortunately, simply taking the standard deduction usually does if you’re a medical sales professional. We take the time to track and comb through every one of your expenses to find eligible deductions. Be it utilities for your home or corporate office, meal and mileage expenses, or training for your entire team, we’ll do the bookkeeping and ensure you claim the full spectrum of deductions to which you are entitled.

Ellinger Tax Services is your trusted partner for tax planning, bookkeeping, and tax preparation.

Let our strategic tax advisors handle the money you’ve made, so you can focus on making more.